ZonaLend

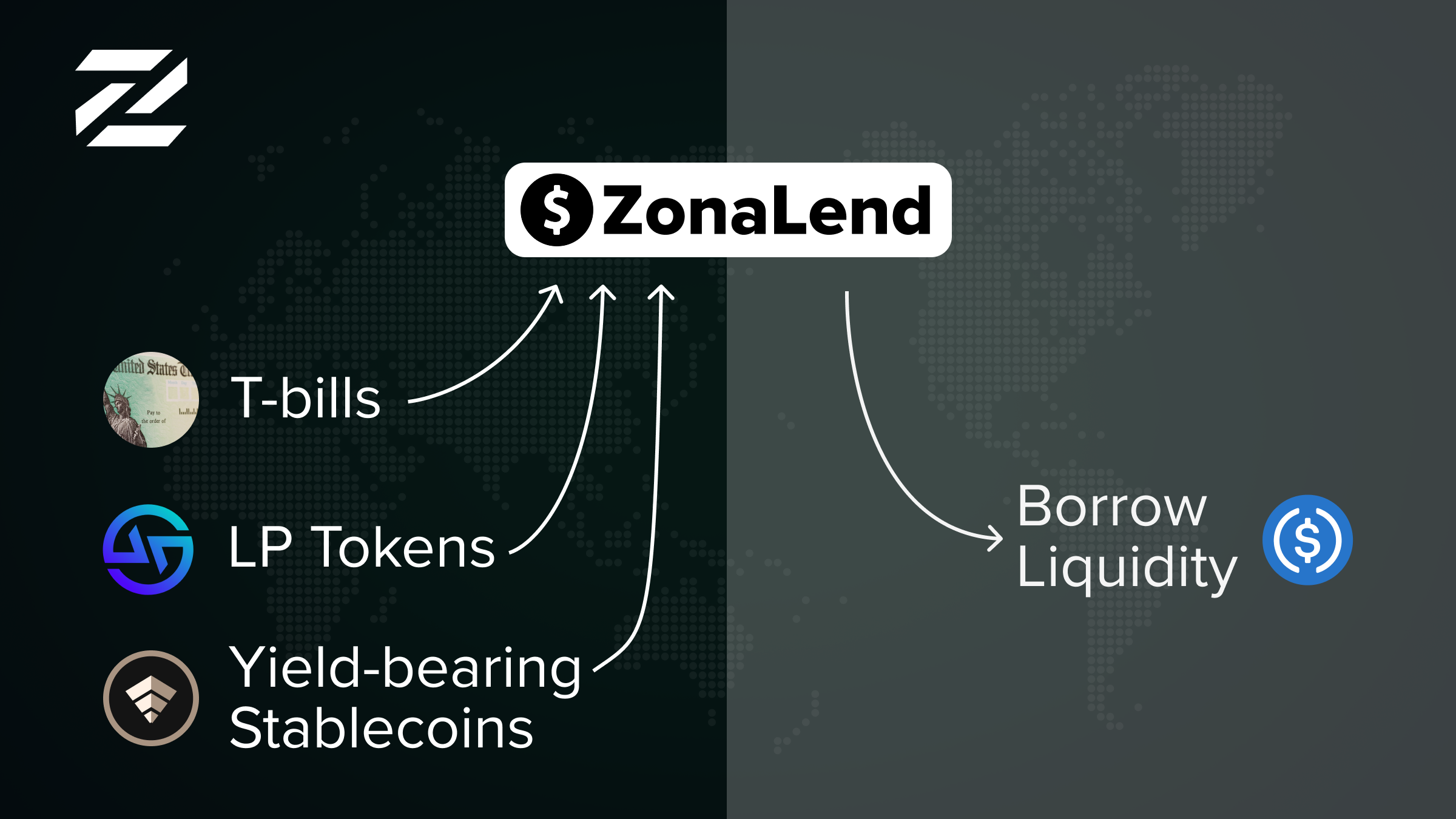

ZonaLend allows users to deposit and borrow in-house RWAs tokenized by Zona, third-party RWAs tokenized by other issuers, and crypto-native assets such as USDT, USDC, WETH, and others.

What are some example use-cases?

Leveraged long: Users can deposit RWA tokens as collateral, borrow stablecoins, use stablecoins to purchase additional RWA tokens, deposit them, and repeat. This looping mechanism functions as a leveraged long on RWA token prices and enhanced exposure to rental income generated by RWAs.

Leveraged short: Users can deposit USDT as collateral, borrow RWA tokens, use RWA tokens to purchase additional stablecoins, deposit them, and repeat. This looping mechanism functions as a leveraged short on RWA, allowing users to profit if the value of the tokenized parking spaces falls.

Non-RWA exposure: In addition to RWAs, Zona's lending product will also support other crypto-native assets such as USDT, USDC, WETH, and others. If users only want exposure to crypto assets, Zona's lending platform is also able to function as other regular lending platforms do.

Yield generation: Users can deposit their RWA tokens, stablecoins, or crypto-assets to earn yield when other users borrow these assets. The yield is generated from interest payments made by borrowers, providing a passive income stream for depositors while their assets remain liquid and accessible.

What will the Maximum Loan-to-Value (LTV) be?

Maximum Loan-to-Value (LTV) ratios will differ per asset based on volatility and available liquidity. For RWA tokens, the initial LTV ratio will be set at 50%, with further adjustments after a period of monitoring.

Lending

What is Lending?

Users can deposit approved digital assets on ZonaLend to earn yield and access untapped capital via overcollateralized loans.

Asset Underwriting & Selection

To ensure protocol stability, every asset supported on ZonaLend undergoes a rigorous review process. Our underwriting framework evaluates both RWA and crypto-native assets based on the following risk metrics:

Market Demand: Evaluation of asset scale, institutional interest, and user requirements.

Liquidity Profile: Assessment of market depth, trading volume, and slippage tolerance.

Volatility Analysis: Review of historical price movements and correlation to broader markets.

Technical Infrastructure: Verification of oracle reliability and DEX integration depth.

Counterparty Quality: Due diligence on issuers, their track record, and redemption capabilities.

Regulatory & Risk Mitigation: Analysis of legal compliance, default risk, and smart contract security.

Who is lending on ZonaLend designed for?

Lending on ZonaLend is designed for:

RWA investors seeking utility for their idle RWA tokens. One such use-case is to deposit RWAs as collateral to take out an overcollateralized stablecoin loan. The loaned capital can then be used for other investments or perform leveraged looping on the same asset, allowing users to earn enhanced yield.

DeFi users who want to deposit their stablecoins or crypto-assets (i.e. WETH) to earn yield when RWA investors borrow these via an overcollateralized loan.

What kind of digital assets will ZonaLend support?

Crypto: Blue-chips (BTC/ETH), Yield-stables (USDe), LSTs (stETH), Perp LPs (GLP), Volatile (Memes).

RWAs: Equities/ETFs (NVDA/S&P500), Treasuries (T-bills), Commodities (Gold), Real Estate (RE Funds).

In-house RWAs tokenized by Zona will be supported in the future. More details will be released in Q2 2026.

Are there any fees associated with lending?

No, there are no fees charged for user supplying their assets on ZonaLend.

Borrowing

What is Borrowing?

ZonaLend allows users who have supplied assets as collateral to take out an overcollateralized loan.

Who is borrowing on ZonaLend designed for?

Borrowing on ZonaLend is designed for:

Unlock Capital Efficiency: Borrow against your holdings without selling them. Use RWAs or crypto-native assets, i.e. DEX LP tokens, as collateral to access stablecoin liquidity for new opportunities or leveraged strategies.

Strategic Hedging & Shorting: Speculate on market movements or protect your portfolio. Borrow specific assets against your collateral to profit from price depreciation or to hedge exposure to volatile markets.

Are there any fees associated with borrowing?

Yes, users must pay interest to asset suppliers when they take out a loan. The interest will vary based on the utilization of the market in question, where a utilization rate of 80% will result in a higher interest rate than a utilization rate of 50%.

The majority of the interest paid will be accrued by the depositors of that market, with Zona taking a small cut as protocol revenue. The cut will differ based on the market, and will be determined by the market's specific Reserve Factor.

Health factor

The Health factor (HF) is a critical metric that indicates the safety of your borrowing position on ZonaLend. It represents the ratio of your collateral value to your borrowed amount, adjusted by the liquidation threshold of your assets.

Understanding Health factor values:

- •HF < 1.0 (LIQUIDATION): Your position is below the liquidation threshold and will be liquidated.

- •HF 1.0 - 1.1 (CRITICAL): Your position is at immediate risk of liquidation. You should add collateral or repay debt immediately.

- •HF 1.1 - 2.0 (SAFE): Your position is safe but should be monitored. Consider adding collateral if approaching 1.1.

- •HF > 2.0 (EXCELLENT): Your position has a strong safety margin. You have significant buffer before liquidation risk.

Liquidations

When the value of a user's collateral on ZonaLend falls below the liquidation threshold, a liquidation is triggered where a portion of the user's collateral is sold to a liquidator at a discount to its market value. The proceeds are then used to repay the user's debt, protecting lenders and preventing bad debt from being accrued by the protocol.

Note that RWA liquidations on ZonaLend are an entirely onchain process and do not involve any offchain redemptions. The logic is similar to a Lido stETH liquidation on Aave, where liquidations occur onchain without staked ETH withdrawals from validators.